Estimate the time saved by outsourcing client bookkeeping solutions tasks or implementing automated solutions. Calculate the hourly cost of internal staff involved in bookkeeping activities and multiply it by the hours saved through outsourcing or automation. Client bookkeeping solutions help ensure compliance by staying abreast of regulatory changes and implementing necessary updates to financial processes and reporting practices. Before diving into the myriad of bookkeeping solutions, it’s important to assess your business’s specific needs.

- From small businesses streamlining their invoicing processes to multinational corporations gaining real-time visibility into their global financial operations, the success stories are diverse and compelling.

- Furthermore, these solutions provide real-time visibility into a business’s financial health, empowering decision-makers with actionable insights that can inform critical business decisions.

- Whether it’s troubleshooting technical issues, seeking advice on best practices, or exploring new features, businesses should have access to reliable support channels to address their needs promptly.

- Automated systems can handle tasks such as data entry, reconciliation, and report generation, saving time and resources.

- Technology automatesclient bookkeeping solutions tasks such as data entry, bank reconciliations, and invoice processing.

- For example, syncing sales data from a CRM system with bookkeeping software streamlines the invoicing process and improves cash flow management.

Client bookkeeping solution providers and their offerings

Bookkeeping solution play a pivotal role in enhancing the operational efficiency and financial health of businesses across industries. In today’s business environment, many small to midsize business leaders are looking for more from their accounting function. Traditional accounting can be a labor-intensive, backward-looking process that, while essential to track your company’s finances and maintain basic bookkeeping, is not a core function of most businesses. It provides a basic amount of financial information but has limited use as a tool to give companies a competitive advantage.

Key Takeaways:

Technology plays a crucial role in maintaining compliance with regulatory requirements such as GDPR or HIPAA, safeguarding sensitive financial information from unauthorized access or data breaches. Regular software updates and security patches further enhance protection against evolving cyber threats. By utilizing advanced software and technology, client bookkeeping solutions ensure accurate financial records. This accuracy is crucial for making informed business decisions and complying with regulatory requirements.

How Client Bookkeeping Solutions Can Transform Your Business

Whether you’re a small startup or a large corporation, understanding the nuances of bookkeeping website is indispensable for sustainable growth bookkeeping solutions and financial stability. Let’s embark on a journey to uncover the essence and importance of bookkeeping in today’s business landscape.

How outsourced accounting can fuel your business’s growth

In short, client bookkeeping solutions not only simplify financial tasks but also help businesses navigate financial challenges confidently. The successful integration of client bookkeeping solutions with existing business processes is a key factor in realizing their full potential. Seamless integration ensures that the software becomes an integral part of the business’s operations, driving efficiency and accuracy across the board. To achieve this, businesses should prioritize clear communication and collaboration between their finance and IT teams, ensuring that the implementation process is well-planned and executed. By automating repetitive and time-consuming tasks such as data entry, reconciliations, and report generation, these solutions enable businesses to operate with unparalleled efficiency. This newfound productivity translates into tangible benefits across the organization, from improved resource allocation to faster financial close processes.

The Present & Future of CAS for Accounting Firms – CPAPracticeAdvisor.com

The Present & Future of CAS for Accounting Firms.

Posted: Fri, 19 Jan 2024 08:00:00 GMT [source]

These may include advanced reporting and analytics tools, mobile accessibility, integrations with third-party applications, and robust security measures to safeguard sensitive financial data. Additionally, providers that prioritize ongoing innovation and product development can offer businesses the assurance of staying ahead of the curve in an ever-evolving technology landscape. Effective training and ongoing support are fundamental components of a successful client bookkeeping solution implementation. Investing in comprehensive training programs for staff members who will be using the software is essential for maximizing its benefits and ensuring proficient utilization. This may involve formal training sessions, online resources, and access to user forums where employees can seek guidance and share best practices.

- In summary, investing in robustbookkeeper service is not only a prudent business decision but also a fundamental aspect of responsible financial management.

- This expertise ensures that financial records are managed efficiently and in compliance with relevant laws and regulations.

- At their core, bookkeeping solutions offer a systematic approach to maintaining accurate and up-to-date financial data, ensuring compliance with regulatory requirements and facilitating informed decision-making.

- These solutions often come with access to experienced professionals who understand accounting principles and best practices.

- Furthermore, our CAS team can transform the way your business accesses and uses financial data to make proactive and strategic decisions.

Modern bookkeeping software offers intuitive interfaces and robust features designed to streamline financial record-keeping. These digital tools allow businesses to easily track income and expenses, categorize transactions, and generate financial reports with just a few clicks. Cloud-based solutions provide the added advantage of accessibility from anywhere https://www.bookstime.com/ with an internet connection, enabling real-time collaboration and remote access to financial data. Automated systems can handle tasks such as data entry, reconciliation, and report generation, saving time and resources. Leading providers in the client bookkeeping space often offer a suite of features that go beyond basic bookkeeping functionalities.

Benefits of Client Bookkeeping Solutions for Your Business

With expertly tailored client bookkeeping solutions, you’ll unleash your business’s full potential by freeing up time to focus on strategic initiatives. Experience the transformative power of harnessing cutting-edge technology to elevate your financial workflows. Get ready to witness a surge in productivity and efficiency that will set your business apart in today’s competitive market. Yes, outsource bookkeeping solutions are suitable for small businesses as they provide cost-effective financial management and free up valuable time for business owners to focus on growth.

- It’s leveraging an experienced external team to handle your business’s financial needs, from basic tasks to more complex business decisions.

- These professionals ensure accurate and compliant record-keeping, minimizing the risk of errors, discrepancies, and regulatory non-compliance.

- Effective bookkeeping ensures compliance with tax regulations, accounting standards, and legal requirements.

- Automated processes not only save time but also reduce the risk of errors, ensuring greater accuracy in financial records.

- This may involve configuring chart of accounts, setting up user permissions, and establishing data migration protocols to ensure a smooth transition.

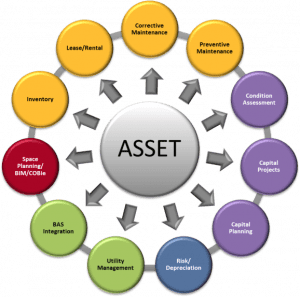

Integrate client bookkeeping solutions website with other business systems and applications to streamline data flows and enhance operational efficiency. Sync accounting software with CRM, inventory management, and payroll systems to ensure seamless information exchange and maintain data integrity across departments. Client bookkeeping solutions equipped with analytical tools provide valuable insights into business performance and financial trends. By analyzing historical data and generating customized reports, businesses can identify areas for improvement, forecast future cash flow, and make data-driven decisions to optimize profitability. Advanced features like predictive analytics and artificial intelligence offer even deeper insights, enabling proactive financial management and strategic planning.