How much cash Was Settlement costs To possess USDA Financing?

Let`s say you’re to invest in a home with an amount borrowed from $160,000 and you can closing costs away from $5,000

With houses costs growing over the Us, preserving 20% for a down payment might seem impossible. Fortunately, there are authorities apps available that generate homeownership a reality at a reduced initial rates.

In the event that living outside the city constraints is ideal for you, a USDA loan might be the perfect fit. USDA funds is given through the All of us Department off Agriculture and provide outlying home buyers access to low interest and you can no down-payment.

Ahead of we talk about the expenses involved with a beneficial USDA mortgage, let’s see how financing system is proven to work.

Just who Qualifies To possess A beneficial USDA Financing?

- You truly must be an excellent U.S. resident or permanent citizen.

- The mortgage should be for a manager-occupied, one-product number 1 residence.

- You truly need to have an established revenue stream that does not meet or exceed 115% of the median money towards you. An important mention let me reveal that, unlike almost every other financing alternatives, USDA takes into account earnings out of most of the mature members of the household. You could potentially subtract childcare expenditures, and just a small quantity of money try West Canaveral Groves loans counted if someone try the full-date beginner.

- You will find limitations with regards to simply how much of the monthly earnings can go towards your mortgage repayment as well as your complete financial obligation.

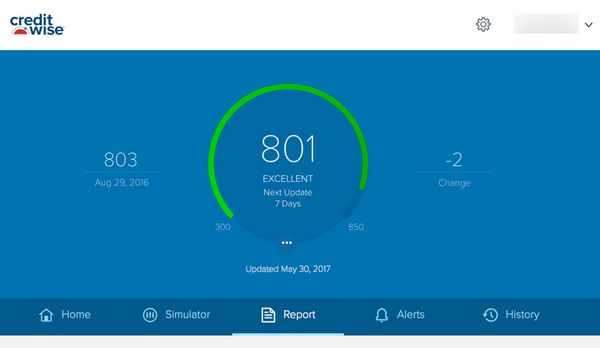

- You have a credit history with a minimum of 640. Without having a credit score or you possess a limited credit history, you may still qualify. But not, lenders can put their own criteria. Rocket Home loan needs an average FICO Rating of 640 or higher.

USDA fund include lots of positives, but they also provide certain costs associated with them. Such as almost every different kind of home loan, you will end up necessary to shell out closing costs. Such can cost you shall be anywhere from step 3% 6% of the loan well worth.

- Origination fees

- Underwriting charge

- Label insurance

- Assessment fee

There are many available options getting investing settlement costs. You’ll be able to that you ount. If your seller was passionate, they might along with agree to shell out a portion otherwise every one of the expense themselves. Although not, it’s usually a lot more of an option if the housing industry is actually slow than the when homes are selling quickly.

One benefit out-of a USDA home loan is the fact they guarantee the loan out of banks or any other lenders. However, in exchange for it guarantee, consumers are required to invest both a USDA upfront make sure fee through to closure the mortgage and you may a yearly make sure commission for every year thereafter.

While this is upgraded from time to time by the USDA, for legal reasons, the most you’ll be charged to have an upfront make sure commission try step three.5% of your mortgage really worth. This fee is currently set within 1% which is computed according to the amount borrowed. The full amount borrowed can include settlement costs, assets upgrades, possessions taxation or any other needed home furniture with the domestic.

The new USDA money commission might be determined considering 1% away from $165,000, otherwise $step 1,650. You’ll have the option so you’re able to sometimes afford the USDA capital commission from the closure or you can roll they into the mortgage.

Whether or not once more subject to unexpected reevaluation, restriction matter which is often energized annual into the USDA ensure fee are 0.5%. The modern percentage is decided during the 0.35% of the annual delinquent mortgage equilibrium. It fee is normally charged to your financial from the USDA and it’s then introduced along to the debtor become paid monthly regarding an escrow account.

Assuming you’d a fantastic home loan balance out-of $125,746 to start the season, new USDA verify payment will be $ predicated on the amortization plan, otherwise $ 30 days.

If you feel an excellent USDA mortgage is the best mortgage to have your upcoming domestic purchase, you can get become that have Skyrocket Home loan today otherwise would a free account on the internet with Skyrocket Money SM . In addition there are touching one of our House Loan Positives in the (800) 785-4788 or look our very own resources having property and personal profit.

Share this post on: