Within the Poland, we have lead a mortgage-connected restoration financing

President statement

We had a quite strong beginning to 2024 which have good economic and you will industrial results once we carried out into the our very own strategy, told you ING Chief executive officer Steven van Rijswijk. Our full earnings features remained good and you will was increased so it quarter from the double-little finger percentage earnings growth, having contributions regarding both Shopping Banking and General Banking. Websites appeal income from financing and you can obligations stayed resilient. Operating expenses enjoys denied because of lower regulating will cost you, and you can our own will set you back was basically manageable, whenever you are chance can cost you had been once again below the courtesy-the-cycle-mediocre. We loans Brilliant have delivered great results even with ongoing demands throughout the geopolitical landscape.

I have added 99,000 primary users that it quarter, spanning the latest and existing consumers who possess chose getting an effective payment membership and at the very least one other product around. It appears their have confidence in united states and shows you how the audience is deepening existing customer matchmaking. This was also seen in the organization around the customer credit, added by mortgage loans as we have aided more folks to find homes, and also in the growth inside customers deposits, primarily inside the Germany and you may Poland.

Percentage income flower 11% in contrast to an equivalent several months a year ago and fourteen% regarding history one-fourth. Development in Shopping is inspired by the highest commission income for both each day financial and you can financing factors. I’ve gained regarding more customers choosing ING due to their banking products and out-of improved plan costs, including out of development in property lower than administration plus what amount of broker trading. Fee income are good to have Globally Money ple, ING are a dynamic bookrunner toward a number of the prominent euro-denominated corporate securities put this current year.

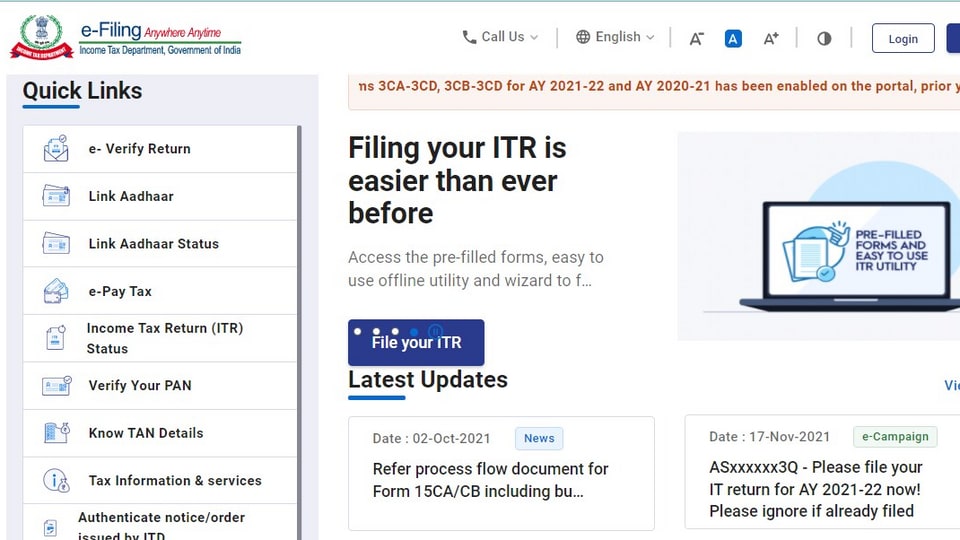

We offer users an excellent experience across our places. Operating Banking, such as, we have revealed an element on Netherlands that enables mobile onboarding for new customers. Inside Poland, we incorporated a product provide webpage towards the ING Business Mobile, making it easier for users observe solutions that will assistance the development of its businesses. For the Wholesale Banking, this new ING InsideBusiness webpage today comes with a collection facts equipment that saves readers date by providing them actual-day knowledge within their credit profile. The fresh airplane pilot was successful and it is now-being prolonged so you’re able to far more clients and you may countries.

I also went on to support subscribers within their durability transitions, on quantity of renewable financing mobilised rising thirteen% on the basic quarter out of this past year so you’re able to 24.eight billion. I have provided a beneficial seven million syndicated facility having Switzerland’s largest supplier regarding renewable energy, together with money from an effective snap ranch and you may battery pack time sites system in australia. Such business support our very own make an effort to multiple our renewable energy capital from the 2025, leading to the change so you can a decreased-carbon business.

Our company is attempting to develop the sustainability offerings in the Shopping Banking, according to all of our aspiration to offer alternative choices for all of our head Shopping products in all of the . This is why consumers to find an awful energy-effective family can be discover a lot more financing to own opportunity renovations, benefiting from discount prices. This is important once the conference websites-zero climate goals inside homes is founded on times home improvements from established belongings.

And also in Romania, you will find offered the instantaneous credit suggestion from the releasing an instant overdraft tool including term finance, providing people a whole providing

We always make all of our investment to our address peak. And then we is actually declaring a portion buyback programme from 2.5 million. Our very own overall performance concur that we are a properly-capitalised bank which have good earnings electricity, permitting us to browse our around the globe functioning surroundings with certainty. I am happy with just how ING provides continued to really make the change of the improving all of our customers’ feel and by spending so much time to help you lay sustainability at the heart out-of what we should perform. This is why i add value for everyone of one’s stakeholders.

Share this post on: